I am including it because it is an example of the kinds of setups we look for, and I believe a very good setup for Monday. I am taking this one with my own money.

Lets look at RELATED MARKETS

When markets are related, if an uptrend is healthy they should go up together.

For example,

The S&P500 Index should go up with the DOW JONES Index and the NASDAQ Index

Crude oil and heating oil should go up together, and go down together

Gold and Silver should go up together and down together.

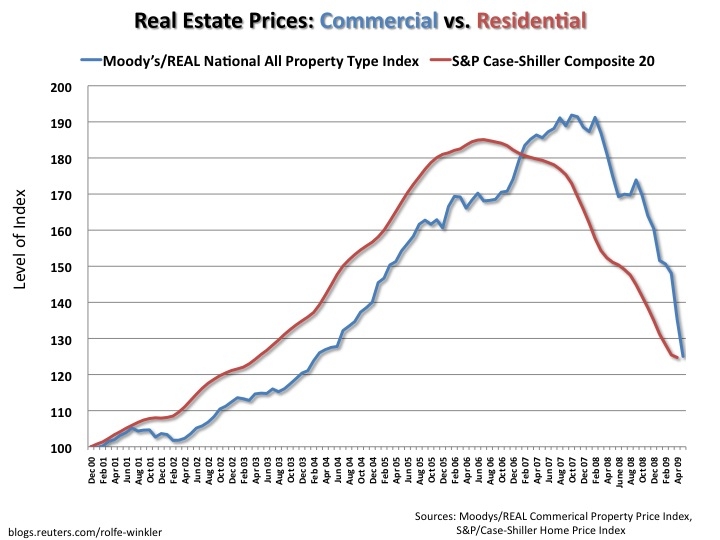

In the real estate market, commercial real estate should go up with residential real estate,

Look at what happened in the US real estate market at the all-time highs! Commercial property made its all-time high without residential property making the same high. This is a CLASSIC end of trend warning signal, and the type of setup 888 Rewards Online learning will teach you about to safeguard your wealth.

Imagine if you were able to sell out of the property market in 06 at the all time highs.

Remember the DOT COM Bubble and the subsequent tech-wreck? Imagine if you were able to sell out at the peak, or even short the market and profit from the fall.

According to the rules I teach you would have been certain to avoid the tech wreck, and profit from the fall.

Have a look at the following chart. The left panel is the Dow Jones Index, and the right panel is the NASDAQ Index. The VERTICAL GREEN LINE is the all time high in the NASDAQ, which was NOT CONFIRMED by a high in the Dow Jones Index.

The behavior exhibited here, where one related market makes a fresh all time high, while the other market does not is called a BEARISH NON-CONFIRMATION.

This was originally discovered over 100 years ago by Charles Dow, (the first editor of the Wall Street Journal, whom the Dow Jones company was named for)

You can read more about it here, http://en.wikipedia.org/wiki/Dow_Theory but you do not really need to know anything more than this.

In two related markets, if one makes a higher high, and the other does not, exit long positions and start to look for short setups. If one makes a lower low, which is not confirmed by the related market, exit short positions and start to look for long entries.

This behaviour is exhibited, right here, today, in the Gold and Silver markets.

This is about as perfect a technical top as you will ever see, bearish non confirmation at the ultimate highs. A mini bearish non-confirmation at the hypothetical current high,.

Gold has retraced approx 61%, silver approx 50%. Ergo, Silver is weaker, objectively, and *should* fall faster and further than gold, all things being equal. Therefore Silver is a better shorting opportunity.

Without predicting what will happen this is a great setup because of its super tight stop and the possibility of a massive fall to the downside.

Risk return heaven!

Scott